How will the low oil and gas prices impact renewables in the UK?

If sustained the falling global price of oil could indirectly reduce the cash available for investment in the UK’s renewable projects – according to industry experts and an analysis of the available data.

The fall in the oil price has contributed towards a fall in the wholesale cost of gas which – in turn – is likely to reduce the UK’s wholesale power price. Over the long term that price is key to determining the cost of renewable support in the UK under the governments Contracts for Difference (CfD) scheme.

“It is a legitimate concern that the downwards pressure on the wholesale price could impact renewables subsidies,” Gareth Miller, principal consultant at Cornwall Energy told Unearthed.

Offshore wind projects planned for between 2016 to 2018 could be particularly at risk if the electricity price remains low, Miller highlighted. Some of those projects are currently seen as important to meeting the UK’s internationally agreed 2020 renewable targets.

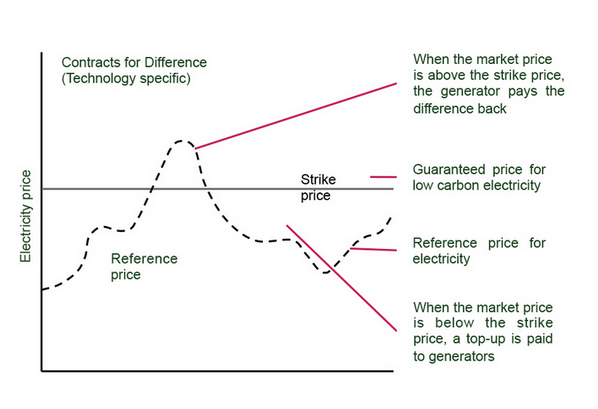

The rationale goes that the amount of renewables subsidies will have to increase because the difference between the strike price, the level of subsidy set by the government, and the reference price, which is linked to the UK’s wholesale power price, will be greater if the wholesale price drops – which it has to around £40 – £45/MWh. (See the graph below for an idea of how this could work.)

Despite the Department of Energy and Climate change (DECC) insists subsidies will be sufficient.

Uncertainties

And there are a lot of uncertainties.

One of these is the wholesale power price itself. It’s volatile, like the value of one of its primary drivers in the UK – the gas price – and we really don’t know what it will do in the future.

With coal and nuclear pretty cheap, gas generators are typically the marginal plant in the current UK electricity market, with the spread between wholesale electricity and gas fuel prices driving their economic viability – so lower gas prices should mainly translate into lower wholesale electricity prices.

“Even under current wholesale power price assumptions there is not enough cash for CfDs to meet all the likely offshore wind demand”- Gareth Miller, Cornwall Energy

Gas prices are linked to the oil price. The Brent oil price is hovering at around $48 per barrel, BP recently predicted the oil price will stay under $50 per barrel in the next few years, while the IEA has said the oil price will rebound to some extent by the end of the year. Although, given the range of import sources in the UK, including Liquified Natural Gas (LNG) the link between oil and gas is weaker than in the past.

However, gas prices have fallen, if less dramatically than oil prices to around £45p/therm for February 2015, with a slight upwards trend in future prices.

Other drivers include the extent of gas demand, the scale of gas storage volumes and the spot price of gas on commodity exchanges.

Another crucial uncertainty is over how, when and whether DECC will respond to the low wholesale electricity price.

Analysts expected DECC to respond to a low UK power price by adjusting its reference price – after all their policy is called Contracts for Difference (CfDs). At the moment the wholesale price is a fairly significant £10 less than the reference price set by DECC last year for 2015/16 of £56/MWh (in 2012 money).

Changing level of subsidy

But DECC would not officially confirm whether it would adjust its reference price before the next round of Contracts for Difference allocations. A DECC spokesperson said: “Long term projections of fossil fuel prices, including the impact of lower wholesale prices, are taken into account in the budget setting process.”

Working under the supposition that the reference price is adjusted, though, another key unknown is whether a low wholesale price or low gas price scenario would result in the Levy Control Framework budget being exceeded if we hit our 2020 renewables share target of 30%.

National Grid did some modelling for DECC in 2013, and ran a low power price scenario through it, where the wholesale price was around £42/MWh in 2020.

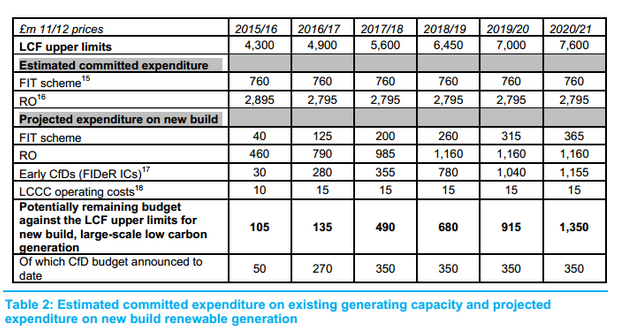

It found that the UK could have a 31% renewables share and spends within the Levy Control Framework (renewables subsidy pot) of £7.6bn to 2020/21 (in 2012 money). According to this modelling, the UK could meet its implicit renewables target of 30% by 2020.

Carbon price uncertainty

It is worth noting that the study assumes the Carbon Price floor will go up to £32 in 2020 and was done before the freeze at £18 until 2019. This means that some of the assumed rise in the wholesale price – which is linked to fossil fuel prices, especially gas – and therefore uplift in the reference price, could have made the results of the modelling more optimistic than realistic.

Meanwhile, the government’s climate advisers, the Climate Change Committee (CCC), have also run some numbers based on a low gas price of 43.2p/therm in 2020 (in 2014 money) and a carbon price of £23 in 2020 (2013 money).

Their analysis features more offshore wind than DECC modelling (in line with government opposition to other forms of renewables) and implies the amount spent in this scenario would be £7.9bn in 2020 (2013 money). Converted to the 2020/21 financial year (for which the LCF cap is set) this would be a spend of £8.15bn.

Breaking levy control framework

Now, this actually does slightly bust the £7.6bn (in 2012 money) cap in the Levy Control Framework – which adjusted for inflation to 2013 money is £7.85bn, so there’s £0.3bn difference.

The CCC claim that there is wiggle room above the Levy Control Framework – 20% headroom agreed between DECC and the Treasury – and that this means they wouldn’t expect a reduction in the gas price to automatically affect 2020 ambition for offshore wind or other renewables.

But it looks like the leeway could only be available to manage cost fluctuations in particular years rather than on top of the cap.

“If headroom is used DECC has to develop plans for bringing spending back to below the cap,” writes DECC in the Electricity Market Reform Plan. This could mean the cap still stands. DECC refused to a request for clarification on how the headroom agreement could work.

But CCC said there are many further uncertainties to consider that could affect the budget, including: whether projects are paid the full strike prices and the balance of renewables projects, such as how much offshore wind is supported.

Leaving the modelling to one side, we do know there are eight renewables projects that have been awarded early contracts last year under a scheme called FIDeR (Final Investment Decision Enabling for Renewables). And if the reference price goes down these contracts, worth £41.2bn to 2020-21, will become more expensive. Over two thirds of these contracts support offshore wind developments.

The remaining budget for Contracts for Difference (p75 in the Annual Energy Statement) in the Levy Control Framework would be reduced as a result.

Miller told Unearthed between 2015 to 2018 there is significant planned potential investment in offshore wind that will be bidding for new CfDs in auctions, as well as a number of the FIDeR projects due to commission and begin utilising money under the LCF.

There are much bigger yearly budgets (see ‘remaining budget’ in below table) to accommodate new CfDs for offshore wind in this period, but Miller stated that “even under current wholesale power price assumptions there is not enough cash for CfDs to meet all the likely offshore wind demand.

“This shortfall would be accentuated if simultaneously FIDeR projects became more expensive and if new CfD bids attained a higher value under the Levy Control Framework as a result of DECC adjusting down their wholesale power assumptions. Put simply, the pot of CfD money would be smaller, and each round of it would buy you less capacity.”

For that reason, if DECC reduce their reference price they might also come under pressure to increase their budget or risk checking the growth momentum in the offshore sector and its role in achieving our 2020 renewable targets.

Higher bills?

“[DECC] are in a tough place – if DECC revise their wholesale power price assumptions now, it reduces the buying power of the budget announced for the first auction round, but if they don’t, and wholesale prices then remain low, it simply means what we buy in the first round turns out more expensive than they planned for and the budget pressure rolls forward into future auctions.” Miller said.

Of course, and DECC increases the budget available to support renewables projects, this would mean an increase in consumer bills. Though if the gas price continues to be low then the rise in renewables support will be dwarfed by the decrease in power costs.

However, a DECC spokesperson said: “The recent fall in gas prices will not reduce the amount of renewables bought with the current CFD budget.

“Consumer bills would not be affected either as projected spending on low carbon electricity is capped. In fact, CFDs help to protect consumers, as we are able to claw back costs from generators if the wholesale electricity price rises above the strike price.”