Financial regulators handed the baton on enforcing climate reporting

Legal authorities may have done the early running in investigating allegations of corporate misreporting of climate risk, but financial regulators on both sides of the Atlantic are now the ones with the baton.

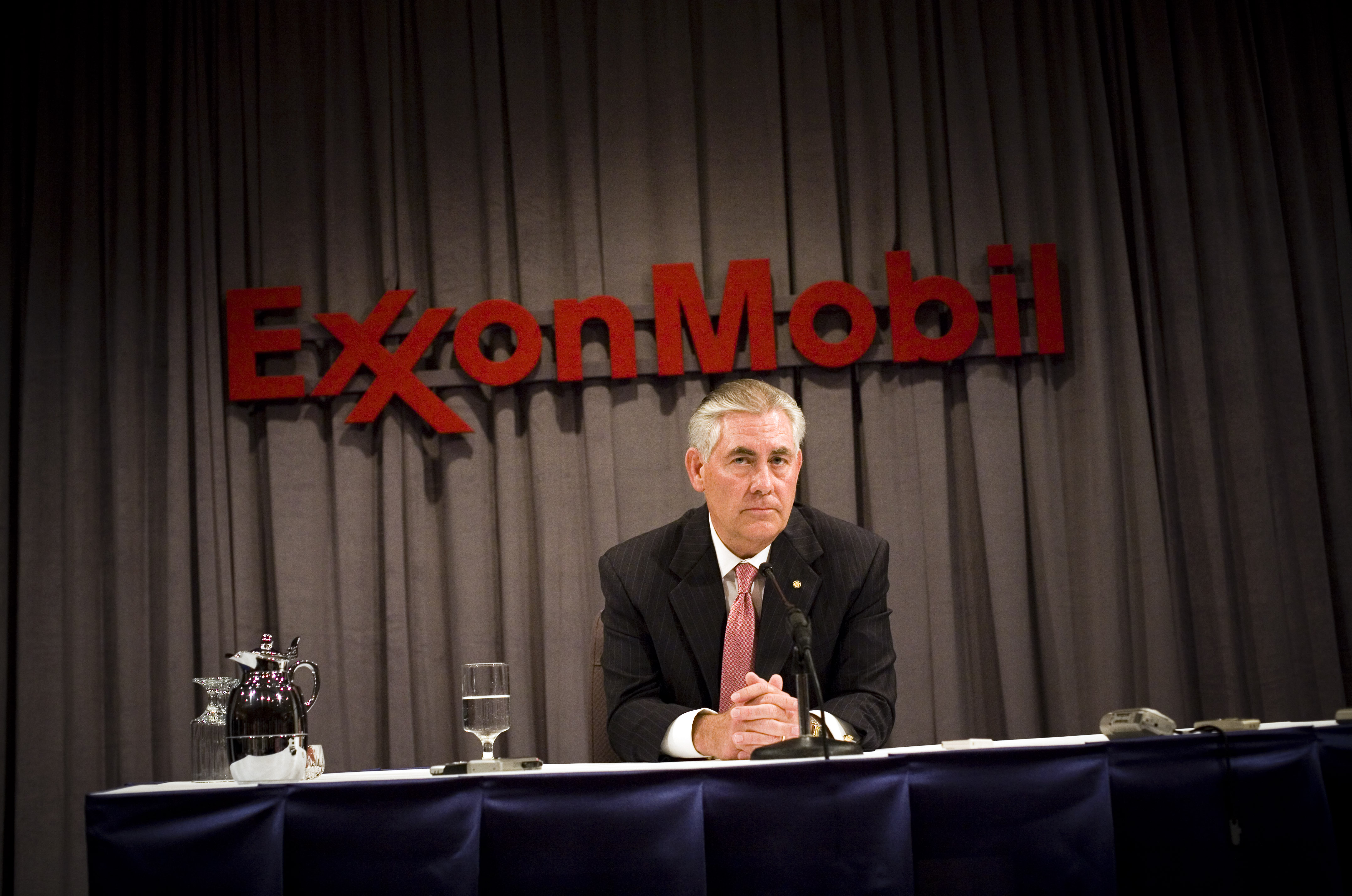

Last week reports emerged that the US Securities and Exchange Commission (SEC) is investigating ExxonMobil.

The probe is reportedly examining both how the oil giant accounts for the value of its assets and reserves, and the adequacy of its regulatory disclosures regarding climate change.

The key issue is whether the company is taking appropriate measures for the increasing likelihood of regulations to address climate change, and the resulting risk of stranded assets.

Meanwhile the Financial Reporting Council (FRC) in the UK has been asked to investigate complaints of inadequate climate risk disclosures in the annual reports of FTSE-listed SOCO International and Cairn Energy.

UK regulator

As the first complaints submitted to a UK regulator for inadequate corporate reporting of climate-related risks, they will prove a test of the FRC’s mettle on monitoring and enforcing reporting rules as they relate to climate change.

These moves come in the context of long-standing investor concern about financial regulators’ enforcement of reporting rules when it comes to climate risks.

Investors are becoming more vocal and united in demanding greater regulatory oversight of corporate climate disclosures.

In August, 130 investors managing $13 trillion called on G20 leaders to “prioritise rulemaking by national financial regulators to require disclosure of material climate risks” and for financial regulators to “regularly evaluate the quality of corporate climate disclosures”.

So, should investors be reassured and should Exxon, SOCO, and Cairn be worried by the these investigations and complaints? Potentially.

The FRC has yet to issue any public statement in response to the complaints but the SEC’s move against Exxon will only serve to increase pressure on it to carry out a thorough investigation.

Neither SOCO nor Cairn’s initial responses serve to provide either much comfort to concerned investors or rebuttal to the complaints. The ball is now in the regulator’s court.

Exxon takes note

The SEC investigation into Exxon is undeniably significant.

The Wall Street Journal called the investigation “a potentially transformative moment for US companies”.

Exxon’s reaction to the SEC probe, however, is in stark contrast to its dismissive response to the New York Attorney General’s decision to examine similar issues.

The company’s statement that it is cooperating with the SEC investigation is perhaps a sign that it does not believe that it will have significant negative impacts.

Exxon has remained defiant despite the increased scrutiny on its business from investors and Attorneys General and political moves that signal an irreversible trajectory to the fossil fuel phase-out needed to keep global average temperature increase well below 2 degrees celsius and ideally no higher than 1.5 degrees celsius.

The company’s latest projections predict that energy demand will increase 25% by 2040, with the bulk of that demand supplied by fossil fuels.

As we have previously noted Exxon appears to have missed or chosen to ignore the signals for the fate of the industry emanating from policy-makers, regulators, and investors.

Don’t mess with the SEC

One cannot ignore that the SEC, traditionally seen as a business-friendly regulator, seems to be taking climate change more seriously as it pertains to risk.

Over the past year, the SEC has consistently signalled an intent to be more stringent on climate disclosure requirements, despite the objections of the fossil fuel industry.

In April, the SEC sought public comment “on modernizing certain business and financial disclosure requirements” and noted a number of requests for greater transparency related to climate change and risk.

And in May, it overruled both Exxon and Chevron and forced the corporations to allow shareholder votes on climate change resolutions at their respective annual general meetings.

Meanwhile the legal investigations and challenges continue. Exxon is still under investigation by the New York Attorney General for potential fraud and by the Massachusetts Attorney General for potential consumer fraud.

The prospect of a Department of Justice investigation remains on the table after a Congressional request for an investigation into Exxon’s alleged climate denial was referred to the FBI.

Exxon’s legal woes are not limited to the US either.

The Commission on Human Rights of the Philippines is investigating 46 fossil fuel producers, including Exxon and its UK peers Shell and BP, for potential human rights violations related to climate change.

Naomi Ages is an attorney and campaigner with Greenpeace USA. Louise Rouse is an investment campaign consultant to Greenpeace UK