Has the gas price plunge made UK fracking unprofitable?

Gas prices have fallen so low in recent months that fracking in the UK may not be economically viable, according to Unearthed analysis using extraction cost estimates from EY, Bloomberg and Oxford University.

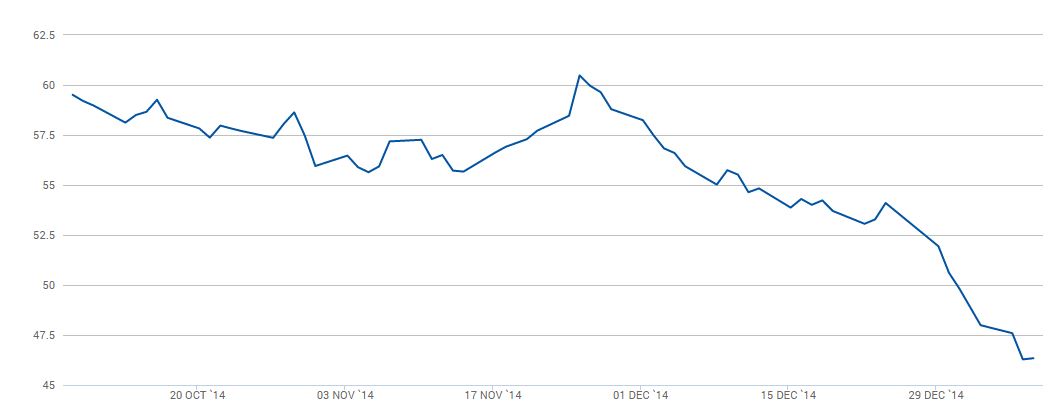

Having crashed alongside oil in recent months, UK natural gas is currently priced at around 46 pence per therm — which may be less than it would cost to extract shale gas.

The low price has also led to concerns about investment in renewable energy because gas power will be cheaper by comparison.

Market projections have the gas price falling further over the next two years, with natural gas futures going as low as 42 pence per therm — though there will probably be a brief respite this winter.

Cuadrilla Resources have said they hope to start commercially fracking in the UK this year, but may face delays unrelated to the gas price.

Gas isn’t guaranteed to get cheaper, with DECC saying the price will rise from 60 pence per therm this year to nearly 71 pence by 2025.

At those sorts of prices, shale gas extraction would likely be economic.

But studies published in the last few years by consultants EY, analysts Bloomberg New Energy Finance and the Oxford Institute for Energy Studies (OIES) indicate that gas prices need to be higher than they are or what the market says they will be for the UK shale gas sector to even break even.

And projections from energy giant Centrica – which owns significant stake in Cuadrilla fracking licenses in Lancashire – would see the sector soon drift into unprofitability, though right now it would be standing on the verge.

In a 2013 submission to Parliament, Bloomberg said it would cost between 47 and 81 pence per therm to extract shale gas in Europe (using current USD-to-GBP conversion rates).

OIES’ 2010 study “Can Unconventional Gas be a Game Changer in European Markets” said shale extraction would likely be even more expensive, costing between 49 and 102 pence per therm.

And EY, in its 2013 report “Shale Gas in Europe: Revolution or evolution?”, went further still, saying it would cost between 53 and 79 pence per therm.

In each of these scenarios, the price of fracking is greater than the price of gas.

Read more: What does the oil price mean for fracking?

As for the Centrica stats, referenced in this 2012 EU report, the current gas price is equivalent to the very bottom of a cost-to-extract range of 46 to 66 pence per therm.

Last summer, Centrica said it was unlikely to bid for further fracking licenses until the shale gas sector is proved viable.

In its statement two years ago, Bloomberg explained that fracking for gas is cheaper in the US than the would be in the UK “because of higher land prices and lack of rigs and infrastructure”.

Shale gas exploration is cheaper than shale oil exploration, which is where the US energy sector is feeling the pinch of the dramatic oil price plunge — recent reports have said 97% of American shale oil fields are operating losses.