China coal power plant approvals fall by 85%

The number of new coal power projects approved by the Chinese government fell by an astonishing 85% last year, a new analysis shows.

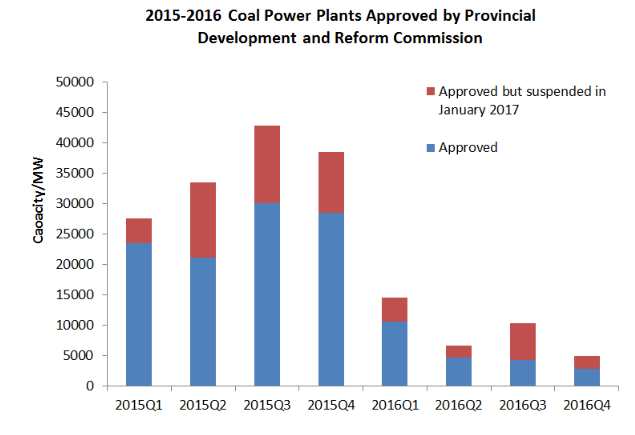

In 2015, 3GW of new coal power was permitted per week. By the second half of 2016, that number had fallen to 1GW per month — the slowest pace in at least 20 years.

In total, 22GW of new coal capacity was authorised for construction last year, and only 6GW in second half — down from 142GW in 2015.

Earlier this year, China suspended more than a 100 planned and under-construction coal projects, the first time in the country’s modern history that the total amount of permitted coal capacity fell.

This comes just days after a Greenpeace analysis of official data showed coal consumption falling for the third year running.

Overcapacity crisis continues

Despite progress made in 2016, China’s policymakers find themselves chasing a fast-moving target.

The country’s top coal miners recently called for reinstating coal output curbs, citing expectations of falling demand.

Meanwhile, about 140GW of capacity is still under construction, and some new projects continue to be approved under different exceptions.

Increasing capacity and falling demand for coal-fired power will see utilization rates for China’s coal power fleet continue to drop like a stone.

Overcapacity continued to worsen dramatically in 2016, with the average utilization of thermal power capacity falling to 47.5%, from 49.8% in 2015, the lowest level in half a century.

This was due to the completion of projects initiated some years ago.

Completion of under construction capacity will already drive capacity to the 2020 target, meaning that there is no space for new construction initiations, unless the retirement target is increased substantially.

Water concerns

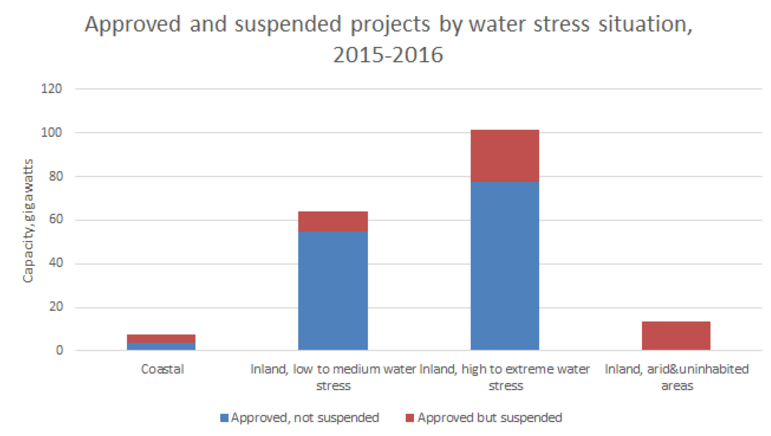

One key concern is that the recent policies have further concentrated generating capacity in regions that already face the worst water stress.

Half of all capacity (11GW) permitted in 2016 is located in high water stress areas, while only 4GW of approved capacity in high water stress areas was suspended. Looking at the 2015-2016 period,

77GW of new capacity in high water stress areas is still allowed to go ahead, while only 24GW was suspended.

Combined heat and power

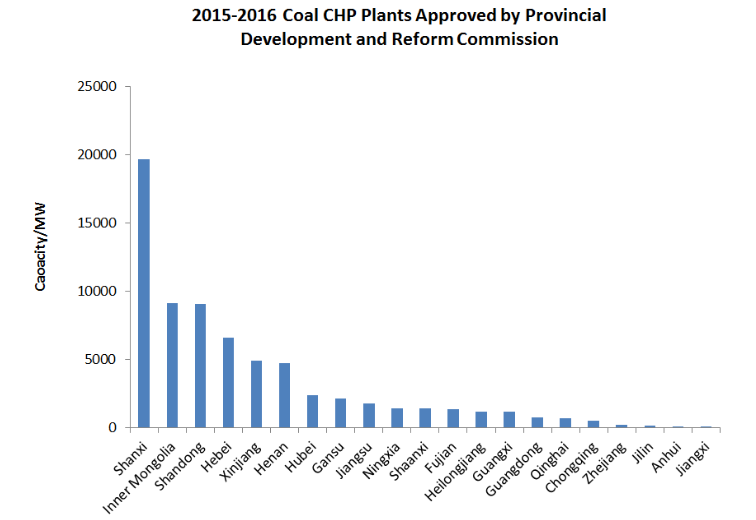

Combined heat and power expansion continues to drive up capacity: authorities continued approving CHP projects in 2016, both industrial and residential, and 25GW of new CHP projects applied for environmental approvals.

14GW of this capacity was in Shandong, raising a serious question about whether continued approval of CHP projects is being used as a loophole for new projects — most CHP plants are designed so that they can operate both as combined heat and power and as power only.

In any case, if CHP expansion continues, up to 70GW capacity could still go into construction and be brought online 2020, leading to a significant overshoot of the total capacity target.

There was continued expansion in Inner Mongolia and Shandong despite a ban on new approvals in these provinces – these projects should not be allowed to go ahead.

Sha’anxi pushed forward with conventional plant expansion, with 7GW greenlighted for construction and another 3GW starting the permit procedure.

Sha’anxi does not have an outright ban on approvals, but the continued permitting of new projects is leading to massive overcapacity in the province.

36GW of coal-fired capacity was originally authorized in 2016, but 14GW was gutted in January 2017. Similarly, 39GW of projects approved in 2015 were subsequently stopped in January 2017, leaving a massive 103GW to potentially go ahead.