Industry calls on Philip Hammond to weaken his planned plastics tax

Leaked documents show the British Plastics Federation's analysis found the tax would boost recycled plastic - but it still plans to oppose it

The UK’s leading plastics trade group is planning to push chancellor Philip Hammond to water down his proposed plastics tax, lobbying documents leaked to Unearthed show.

This is despite the group’s own analysis showing the proposed tax would significantly boost the use of recycled plastics in packaging, one of the tax’s core goals.

Hammond announced plans at last year’s Budget for a tax on all plastic packaging containing less than 30% recycled content from April 2022, as part of efforts to become “a world leader in tackling the scourge of plastic littering our planet and our oceans”, the chancellor said when delivering the Budget.

The Treasury is currently consulting on the proposals, which Hammond said were aimed at “transforming the economics of sustainable packaging”.

But the British Plastics Federation (BPF), which represents over 500 manufacturers, plans to lobby the Treasury to delay the introduction of the tax and possibly start with a lower threshold on recycled content, leaked meeting minutes show.

BPF representatives met Treasury officials to discuss the plastics tax on Wednesday, ahead of submitting its response to the consultation next week.

Last year, the BPF signed the Plastics Pact, an industry agreement marshalled by the waste charity Wrap that aims to boost plastics recycling and reduce littering. Part of the Plastics Pact is to introduce an average of 30% recycled content for plastic packaging by 2025.

‘Short-term thinking’

But the documents show the trade association plans to argue against the government’s own plans to boost recycled plastic in packaging, and suggest alternatives to the plastic tax.

Simon Ellin of the Recycling Association said the BPF’s opposition to the tax “is pretty short-term thinking and smacks a bit of protectionism”.

He said that the tax would boost the UK’s plastic recycling industry: “I get where the BPF is coming from but the government have very much realised that… if you create the demand [for recycled plastic] you create the supply.”

Ellin added: “The long term picture we can’t get away from is you will have a far, far healthier industry because of it.”

The BPF has commissioned consultants Ernst & Young to produce its consultation response.

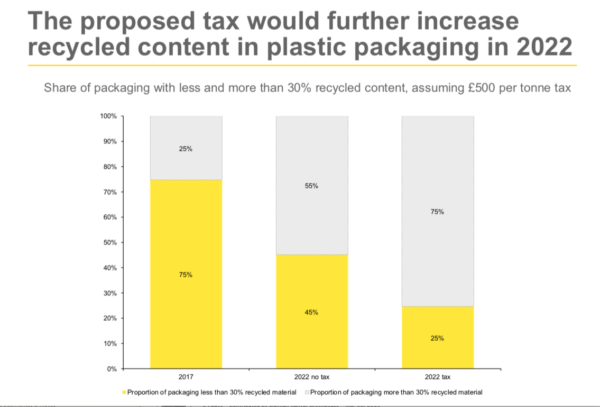

Ernst & Young’s analysis, which was shared with the BPF at a meeting in mid-April, finds that the proposed tax would increase the proportion of packaging using at least 30% recycled plastic from a quarter in 2017 to three quarters of all packaging on the market in 2022.

But it also warns that the tax could hit jobs in the sector and push up prices for poor households.

The consultancy lists three options for the BPF: gather evidence to support the “do nothing approach”, look for ways to water down the tax proposal, or “seek to supplant the current proposal with an alternative proposal”.

‘Unintended consequences’

Documents from the BPF meeting show the trade association calling on members “urgently” to provide Ernst & Young with case studies “about the unintended consequences of the plastic packaging tax” to use in its response to the Treasury’s consultation. These should include “any examples that increase the amount of overall waste or result in the use of more difficult to recycle formats simply to meet the requirements of tax,” the minutes say.

The BPF also sought case studies of manufacturers moving their operations abroad to avoid the tax. “[A]ny cost related examples would be ideal,” the documents note.

The meeting decided the BPF’s consultation response should argue the tax “needs later implementation” to deal with problems such as a lack of supply of recycled plastic, “possibly commencing with a lower r/c [recycled content] threshold”, and should set out exemptions to the proposed tax.

A spokesman for the BPF said: “The plastics industry wants to increase the amount of recycled content in its products and we are working to overcome the numerous technical challenges to introducing 30% recycled content across all plastic packaging formats. These are due to food safety laws and the need to keep packaging as resource efficient as possible.”

He argued that using recycled content could sometimes “result in using more plastic, not less” and added that it could make products “extremely difficult to recycle”.

The spokesman added: “It is for these reasons that the plastics industry is providing detailed information to the government to ensure the best environmental outcome and that the money raised is reinvested in improving our national collection and recycling infrastructure.”

Read the full documents here: